Nearly 60 million Americans are in debt. That’s a lot of people struggling to make ends meet. Debt can feel like a suffocating weight, causing stress, and anxiety, and even leading to financial ruin. If you’re struggling to stay afloat, National Debt Relief might be the breath of fresh air you need.

1. National Debt Relief – A Trusted Partner in Debt Freedom

Founded in 2004, National Debt Relief has helped 500,000 people break free from the chains of debt. Their team of seasoned professionals is expert in navigating the complexities of financial struggles.

As a private company, National Debt Relief offers two main types of powerful tools for Debt Reduction:

- Debt consolidation: National Debt Relief will help you consolidate your debts into one monthly payment with a lower interest rate. This can make it easier to manage your debt and save money on interest.

- Debt negotiation: National Debt Relief will negotiate with your creditors to reduce your debt or interest rates. This can save you a significant amount of money.

Is National Debt Relief right for you?

If you meet these criteria, National Debt Relief could be your answer:

- Have at least $7,500 in unsecured debt.

- Earn enough to comfortably cover the program’s monthly payments.

- Ready to temporarily pause direct payments to creditors.

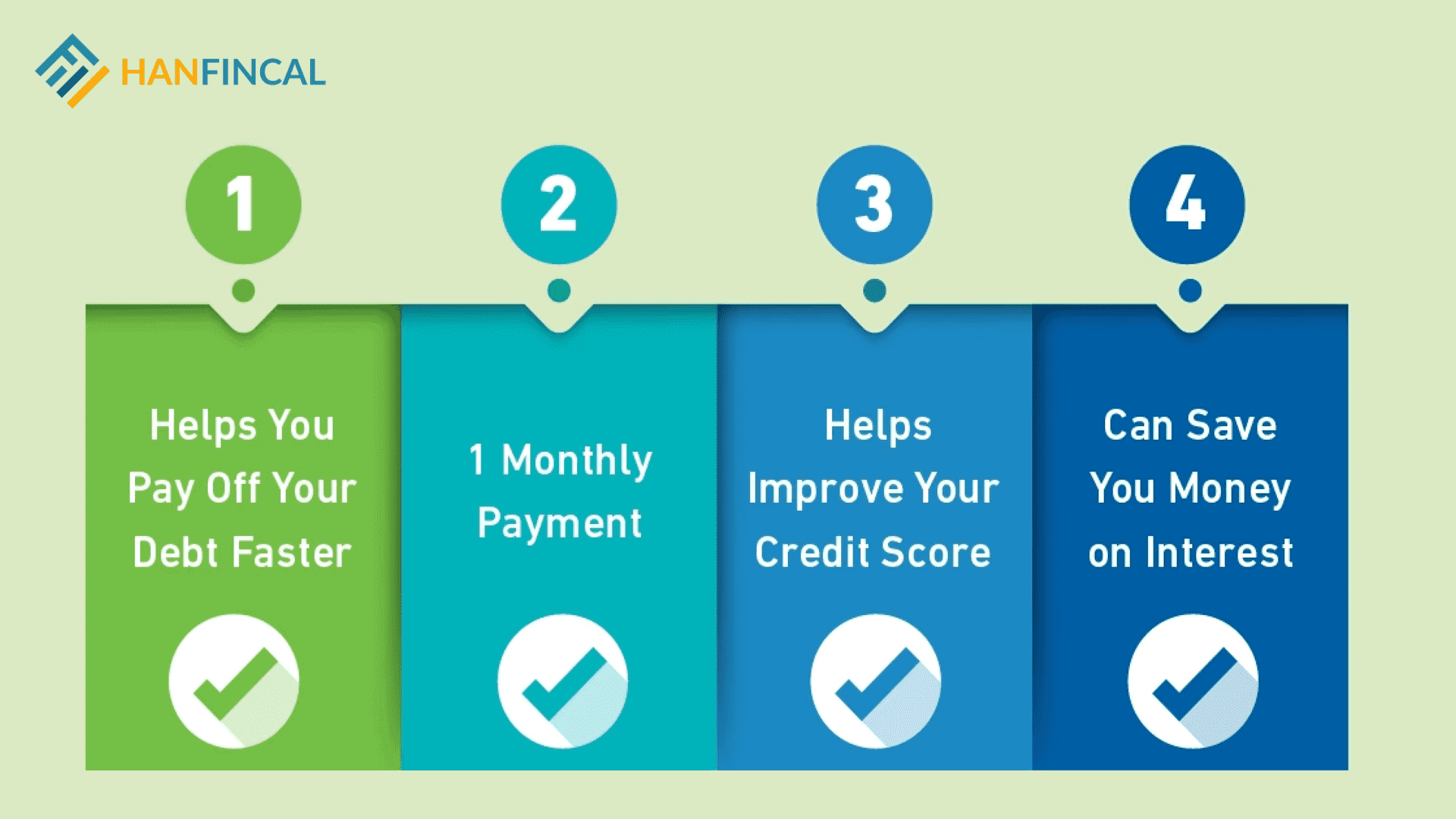

2. What are the benefits of using National Debt Relief?

National Debt Relief can offer a number of benefits, including:

- Reduced monthly payments: National Debt Relief can help you reduce your monthly payments by combining your debts into one payment or negotiating with your creditors to lower your interest rates.

- Saved money: National Debt Relief can help you save money on interest and fees by consolidating your debt or negotiating with your creditors.

- Improved credit score: National Debt Relief can help you improve your credit score by negotiating with your creditors to remove late payments or other negative items from your credit report.

- Peace of mind: National Debt Relief can help you take control of your finances and achieve debt freedom.

3. How does National Debt Relief work?

- The process of working with National Debt Relief is relatively straightforward. First, you’ll need to contact the company and provide them with information about your debts.

- National Debt Relief will then review your information and determine which type of debt relief is right for you.

- If you choose debt consolidation, National Debt Relief will work with you to create a budget and develop a payment plan. The company will then negotiate with your creditors to get the best possible interest rate on your consolidated debt.

- If you choose debt negotiation, National Debt Relief will negotiate with your creditors on your behalf. The company will work to get your creditors to agree to reduce your debt or interest rates.

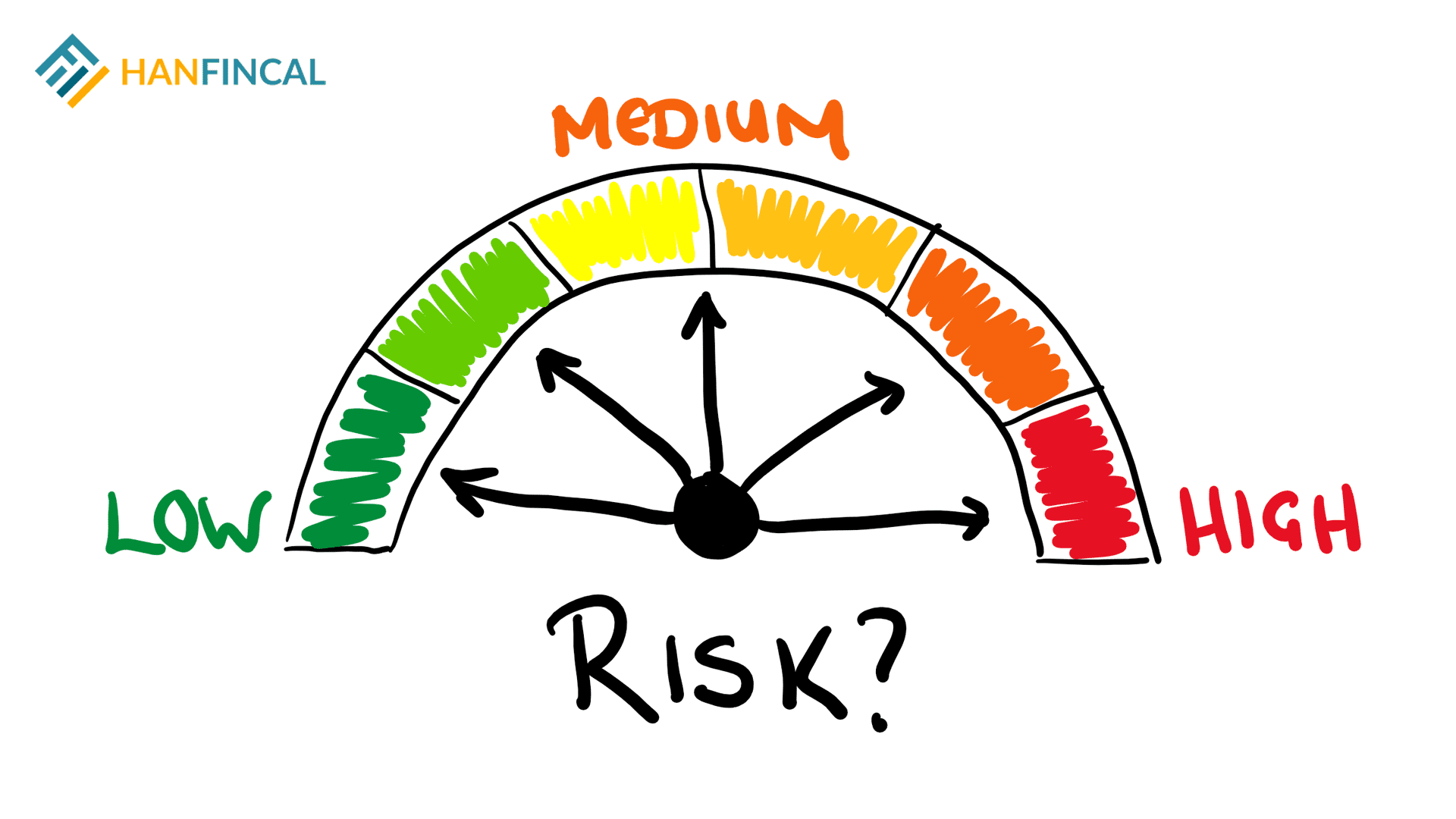

4. Are there any risks in choosing National Debt Relief?

National Debt Relief might seem like a beacon of hope in this financial storm. While their services can be helpful, it’s crucial to approach any debt relief solution with cautious awareness. Just like any financial decision, there are potential risks involved.

Understanding these risks empowers you to make informed choices and navigate the path to financial freedom with clarity.

- Fees: National Debt Relief charges fees for its services. These fees can vary depending on the program you choose.

- Impact on credit score: Debt relief can temporarily impact your credit score. However, your credit score should recover over time, especially if you make all of your payments on time.

- Risk of default: If you are unable to make your payments to National Debt Relief, you may default on your debt. This could damage your credit score and make it more difficult to obtain credit in the future.

Directly Connect To Debt Expert Today

Don’t let debt suffocate your dreams. National Debt Relief offers a potential path to financial liberation. Remember, informed decision-making and choosing the right partner are keys to success. Take the first step towards financial freedom today and breathe easy again!