From flexibility to spending as needed to fixed monthly payments, personal loan options are a popular choice for borrowers. Personal loans up to $50,000 can be used for just about anything, from home improvement projects to debt consolidation. In some cases, personal loans can even help improve your credit score.

However, whether you have good or bad credit, qualifying for a $50,000 personal loan requires your undivided attention (locking in the potential offer and understanding how the lender works).

1. Overview

If you’re facing a financial quandary requiring a significant sum, 50kLoans.com might be the answer you’ve been searching for. This online lending platform in the US specializes in connecting borrowers with personalized loans of up to $50,000.

- Time to fund: As soon as the same business day

- Loan amounts: $500 – $50,000

- APR: 5.99% (Minimum)

- Repayment terms: 61 days – 10 years

- Origination fee: None

1.1. Loan Purpose:

50kLoans.com is dedicated to assisting individuals, families, and organizations facing financial challenges and in need of loans for any reason. Here are some common scenarios for seeking financial support:

- Auto

- Credit Card

- Debt Consolidation

- Debt Relief

- Debt Settlement

- Education

- Home Improvement

- Medical

- Relocation

- Renewable Energy

- Small Business

- Travell

- Wedding

- Other

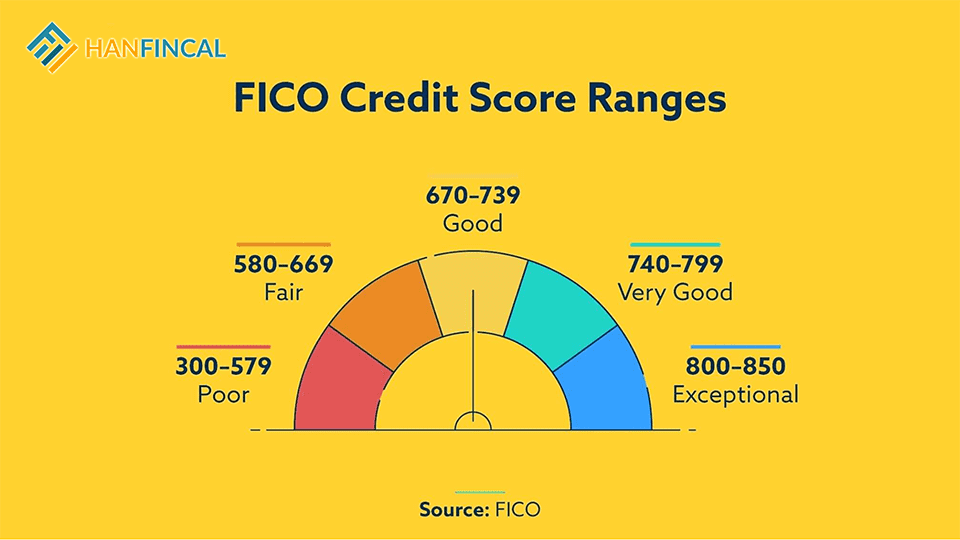

1.2. Credit Score

- Excellent (720+)

- Good (660-719)

- Fair (600-659)

- Poor (<600)

- Not sure

At 50kLoans.com, they welcome all credit types. Your financial history shouldn’t be a barrier to getting the support you need.

2. Advantages

The advantages of their service are manifold, offering a seamless and efficient experience for users seeking financial assistance, which makes it a good option for you.

- Quick approval: 50kLoans.com claims to be able to approve loans within 24 hours. This can be helpful if you need money quickly.

- Simple: Through our advanced automated system, requesting up to $50,000 is a breeze, requiring just a few minutes to complete a clear-cut form on your computer, tablet, or mobile phone.

- Fast: Beyond the speed and simplicity, our commitment to affordability stands out as we prioritize assisting you, irrespective of traditional credit scores.

- Affordable: With a commitment to affordability, they look beyond credit scores to provide tailored loan offers, ensuring your financial journey is not hindered by past credit history.

- Secure: Rest assured, your information is in safe hands; they employ the latest technology and stringent data security procedures to ensure the confidentiality and security of your details.

Connect directly to the lender

3. Eligibility Requirements

To qualify for a 50kLoan.com Lender, you need to meet these basic criteria:

- Be a US citizen or a legal resident

- Be at least 18 years old

- Have a stable income

- Have an active bank account

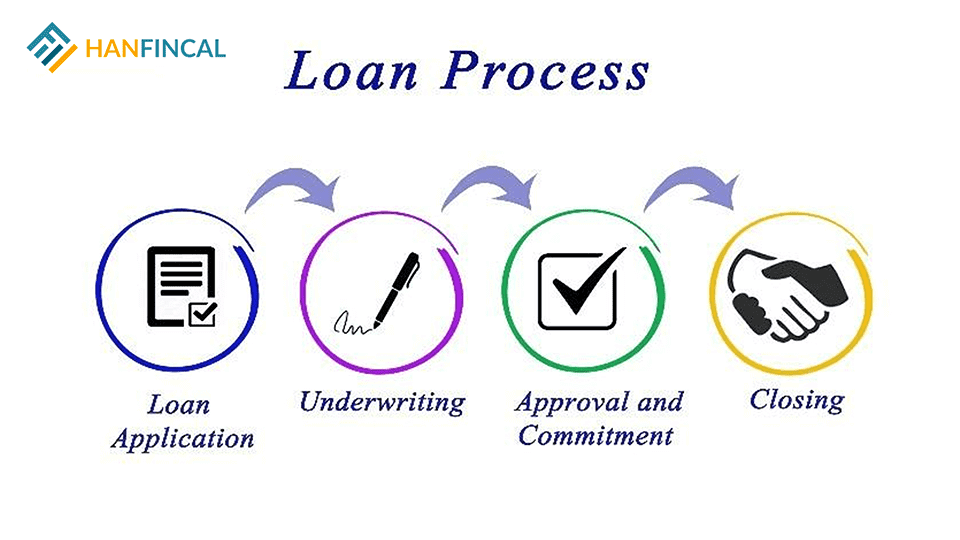

4. Loan Process

Navigating the loan process with 50k Loans.com is straightforward. Let’s experience a hassle-free loan process designed for your convenience with 50kLoans.com.

- Submit A Request: All the paperwork is gone! The whole process is completely online.

- Review Your Application: The lender will review your application and contact you if you are approved.

- Sign The Loan Documents: Once you are approved, you will need to sign the loan documents. The loan documents will include the terms and conditions of the loan, such as the interest rate, fees, and repayment schedule.

- Receive Your Fund: Once you submit your request, get your offer, and e-sign it, you’ll be able to get the funds to your bank account in no time!

Apply with your desired amount

5. FAQs

5.1. When are $50,000 loans worth it?

- Some loans are intended for a specific use, but some other loans will allow you to spend as you please (as long as it’s within what’s allowed). A personal loan for $50,000 could be used for one thing or a mix of things. Most personal loans have few spending restrictions. When determining if a loan is worth it, consider the following:

- What is the total loan cost?

- Will the loan help you get ahead?

- Will you encounter financial hardship with an extra payment?

- Is it better to pay cash or finance?

5.2. How will I receive my loan?

- During the loan application process, you’ll have the opportunity to tell us how you want the funds disbursed. They can: Deposit funds directly into any of your bank accounts

5.3. How do you get a $50,000 personal loan with bad credit?

- Before applying for a $50,000 loan, check your credit score. While a score of at least 600 is preferred, some lenders may consider lower scores. Prepare documents like proof of identity, address, and income for a smoother application process.

- If your credit score is a concern, improve it before applying. Timely payments, reducing debt, and ensuring sufficient income can enhance eligibility. Prioritize these steps to increase the likelihood of a successful loan application.

5.4. Does a $50,000 personal loan hurt your credit?

- A $50,000 personal loan can briefly lower your credit score due to borrowing and a hard credit pull. However, making timely payments can lead to a recovery, and in the long run, your score may even surpass its initial level. Regularly monitoring your credit helps detect and address issues promptly.